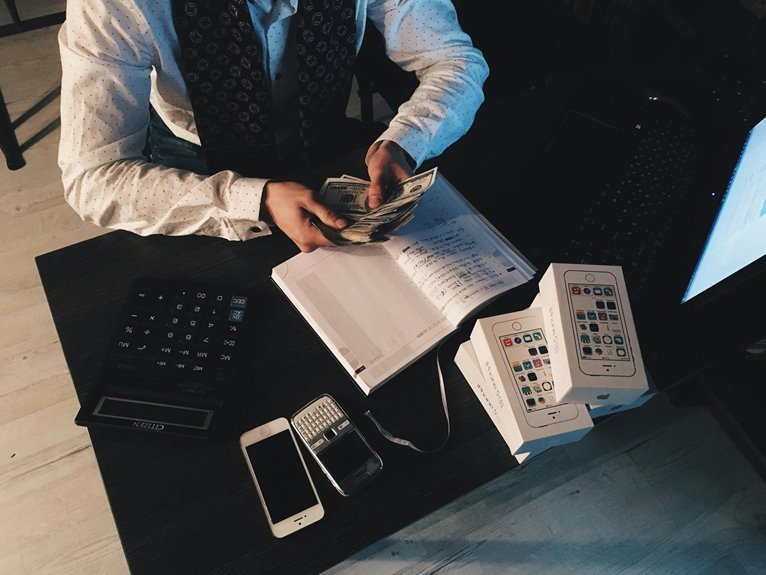

Financial Strategy and Bookkeeping Mastery 8446338356

In the realm of business operations, the interplay between financial strategy and meticulous bookkeeping is critical. Effective financial strategies establish a roadmap for growth, while diligent bookkeeping ensures that this path is navigated with precision. By integrating these two components, businesses can enhance their decision-making processes and sustain long-term viability. The question remains: how can one effectively harness these practices to not only survive but thrive in a competitive landscape?

Understanding the Basics of Financial Strategy

Understanding the basics of financial strategy is essential for organizations aiming to achieve long-term sustainability and growth.

Establishing clear financial goals allows organizations to focus their resources effectively.

Budgeting fundamentals provide the framework for monitoring and controlling expenditures, ensuring alignment with strategic objectives.

Essential Bookkeeping Practices for Small Businesses

Effective financial strategy relies heavily on accurate and timely bookkeeping practices, particularly for small businesses striving to establish a strong financial foundation.

Essential practices include diligent invoice management to ensure prompt payments and comprehensive expense tracking to monitor cash flow.

These foundational elements enable small businesses to make informed decisions, ultimately fostering financial independence and supporting sustainable growth in a competitive marketplace.

Tools and Software to Streamline Financial Management

As small businesses navigate the complexities of financial management, the adoption of specialized tools and software becomes crucial for enhancing efficiency and accuracy.

Cloud accounting platforms facilitate real-time financial oversight, while automated expense tracking tools minimize manual errors.

These resources empower entrepreneurs to focus on growth, providing them with the freedom to make informed decisions based on reliable financial data and insights.

Developing a Strategic Financial Plan for Growth

While many small businesses recognize the importance of financial planning, developing a strategic financial plan for growth requires a systematic approach that aligns with both short-term objectives and long-term vision.

This involves precise growth forecasting to predict future revenues and meticulous budget allocation to ensure resources are effectively directed towards initiatives that drive expansion, ultimately fostering a sustainable path to financial independence.

Conclusion

In conclusion, the integration of robust financial strategies with meticulous bookkeeping is paramount for sustainable business success. Remarkably, studies indicate that 82% of small businesses fail due to cash flow mismanagement, underscoring the critical need for accurate financial oversight. By leveraging modern tools and establishing clear financial goals, businesses can not only navigate challenges but also position themselves for growth. This mastery empowers entrepreneurs to make informed decisions, ultimately leading to enhanced financial independence and longevity in the market.