Achieving Financial Clarity With Bookkeeping 3462149844

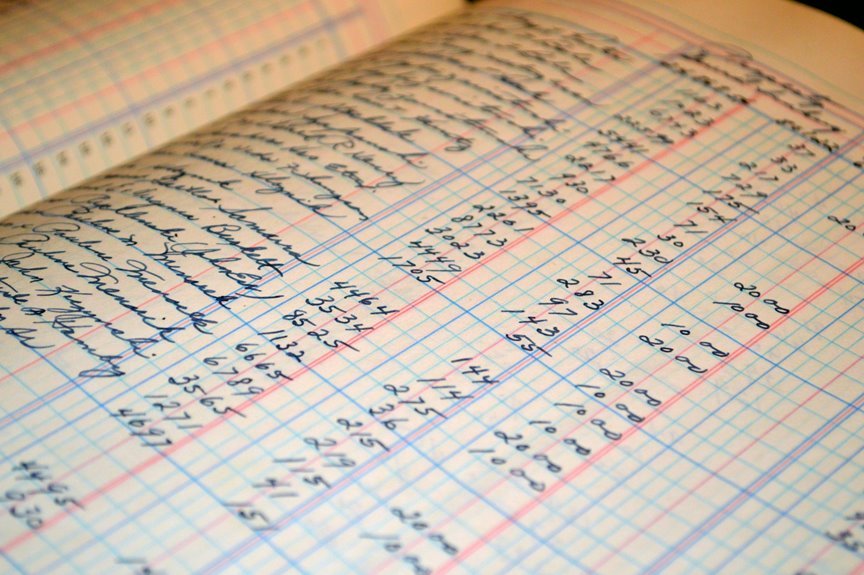

Achieving financial clarity through bookkeeping is essential for organizations aiming to improve their economic stability. Effective bookkeeping allows for systematic tracking of transactions and categorization of expenses. This process not only informs strategic decision-making but also enhances transparency in financial management. Understanding the nuances of bookkeeping can provide organizations with insights into spending patterns and resource allocation. However, the implementation of these practices raises important questions about long-term financial sustainability and the complexity of compliance.

Understanding the Importance of Bookkeeping

Bookkeeping serves as the backbone of financial management in any organization, providing essential insights into its economic health.

Mastering bookkeeping basics enables effective financial organization, facilitating informed decision-making.

Accurate records of income and expenses empower businesses to track performance, ensure compliance, and plan strategically.

Thus, understanding the importance of bookkeeping is fundamental for those seeking autonomy and clarity in their financial endeavors.

Key Features of Bookkeeping 3462149844

Effective bookkeeping encompasses several key features that collectively enhance financial accuracy and operational efficiency.

Central to this process are transaction tracking and expense categorization, which enable businesses to maintain up-to-date records and analyze spending patterns.

These features empower organizations to make informed financial decisions, ensuring a clear understanding of their fiscal status and facilitating greater autonomy in managing resources.

How to Implement Effective Bookkeeping Practices

Implementing effective bookkeeping practices requires a systematic approach that prioritizes organization and accuracy.

Employing digital tools can enhance efficiency in expense tracking, allowing for real-time data management. Establishing a consistent schedule for recording transactions ensures financial records remain up-to-date.

Moreover, regular reconciliation of accounts fosters transparency and mitigates discrepancies, ultimately enabling individuals to maintain financial clarity and achieve greater autonomy over their financial decisions.

The Benefits of Financial Clarity for Your Future

Financial clarity serves as a cornerstone for informed decision-making and strategic planning. It empowers individuals to articulate and pursue their financial goals effectively.

Conclusion

In conclusion, effective bookkeeping serves as the compass guiding organizations through the complex seas of financial management. By fostering clarity and transparency in financial records, businesses can navigate challenges with confidence and precision. Implementing robust bookkeeping practices not only enhances decision-making but also cultivates a foundation for long-term fiscal health. Ultimately, organizations that prioritize these practices position themselves to weather economic fluctuations and seize opportunities for growth, ensuring a more prosperous future.