Financial Clarity Through Bookkeeping 3143264401

Financial clarity is a crucial element for any business aiming for longevity and success. Organized financial records facilitate accuracy and compliance with regulations. Effective bookkeeping encompasses various key components that can significantly impact decision-making. Additionally, advancements in technology can enhance these processes. Understanding how these elements interconnect can provide deeper insights into a company’s financial health and future potential. The implications of these practices merit further examination.

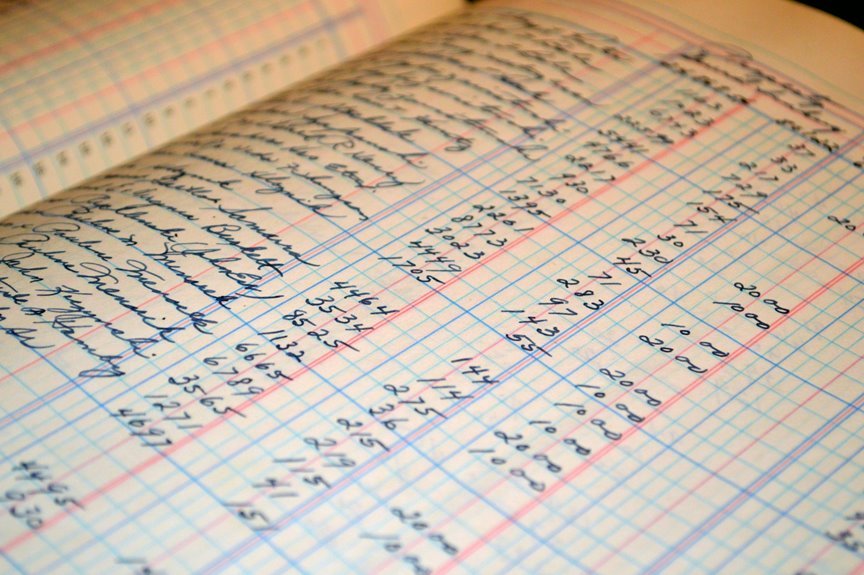

The Importance of Organized Financial Records

Although many businesses recognize the necessity of financial records, the true importance of organization often goes overlooked.

Organized financial records enhance record accuracy, which is crucial for tax compliance. Disorganized documentation can lead to errors, legal issues, and financial discrepancies.

Key Components of Effective Bookkeeping

Effective bookkeeping encompasses several key components that collectively ensure accurate financial management.

Central to this practice are reconciliation processes and meticulous expense tracking. Reconciliation processes verify the accuracy of financial records, while expense tracking monitors expenditures, providing insights into spending patterns.

Together, these components foster transparency, enabling informed decision-making and financial freedom. Effective bookkeeping ultimately lays the foundation for sustainable financial health.

Utilizing Technology for Streamlined Processes

The integration of technology into bookkeeping processes enhances efficiency and accuracy in financial management.

Cloud solutions enable real-time access to financial data, promoting collaboration and transparency.

Meanwhile, automation tools streamline repetitive tasks, reducing errors and saving time.

Making Informed Financial Decisions With Clarity

When businesses possess clear and accurate financial data, they are better equipped to make informed decisions that drive growth and sustainability.

This clarity provides vital financial insights that enable the development of effective budgeting strategies.

Conclusion

In conclusion, the role of effective bookkeeping in achieving financial clarity cannot be overstated. According to a recent study, businesses that maintain organized financial records are 30% more likely to succeed in their first five years compared to those that do not. This statistic underscores the critical nature of meticulous record-keeping and informed decision-making. By leveraging technology and embracing systematic processes, businesses can not only enhance their operational efficiency but also foster trust and sustainability in their financial practices.