Key Techniques in Bookkeeping 5089486999

Effective bookkeeping is vital for any business striving for financial accuracy and growth. Key techniques, such as double-entry accounting and regular reconciliation, serve as the backbone of a sound financial system. The integration of bookkeeping software can significantly streamline processes, enhancing efficiency. Additionally, a consistent record-keeping system fosters compliance and provides critical insights. Understanding these techniques can reveal their impact on long-term business success, prompting further exploration of their implementation.

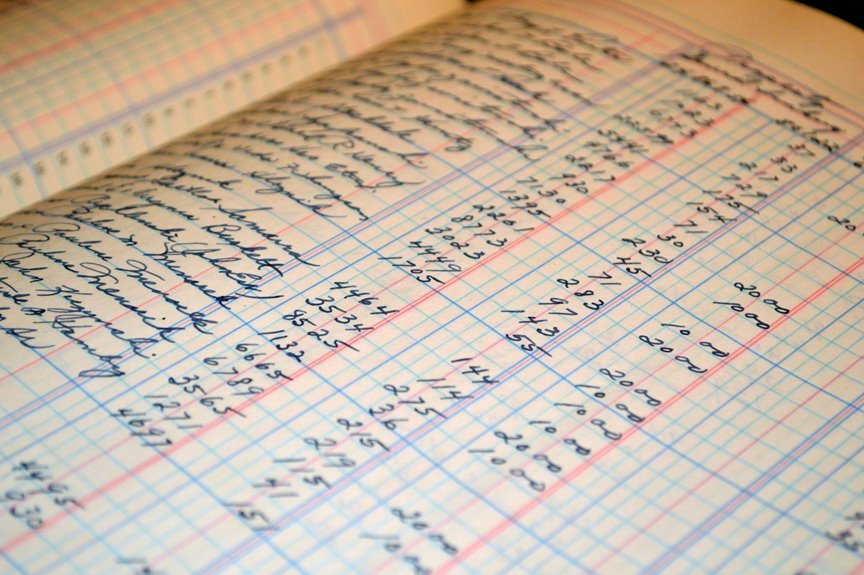

Understanding Double-Entry Accounting

Although many accounting methods exist, double-entry accounting remains the foundation of modern bookkeeping practices. This system requires every transaction to be recorded as both a debit and a credit, ensuring accuracy and balance.

Utilizing Bookkeeping Software

As businesses increasingly seek efficiency in their financial processes, utilizing bookkeeping software has become essential.

Cloud-based solutions facilitate real-time access to financial data, enhancing collaboration and decision-making.

Additionally, automated invoicing streamlines billing procedures, reducing human error and saving valuable time.

Implementing Regular Reconciliation

Implementing regular reconciliation is a critical practice for maintaining accurate financial records in any organization.

This process involves comparing a company’s internal records against bank statements, ensuring all transactions are accounted for through effective transaction matching.

Regular reconciliation not only identifies discrepancies but also fosters financial transparency, empowering organizations to make informed decisions and maintain fiscal integrity.

Developing a Consistent Record-Keeping System

A consistent record-keeping system serves as the backbone of effective bookkeeping, ensuring that financial data is organized, accessible, and reliable.

By employing systematic record organization and diverse documentation methods, businesses can streamline their processes and enhance accuracy.

This approach not only facilitates compliance with regulatory requirements but also empowers decision-makers with timely insights, ultimately supporting financial freedom and strategic growth.

Conclusion

In conclusion, mastering key bookkeeping techniques is not merely a matter of routine; it is a strategic imperative that can determine the fate of a business. As organizations navigate the complexities of financial management, the stakes rise—will they emerge resilient and informed, or falter in uncertainty? The deliberate adoption of double-entry accounting, sophisticated software, and rigorous reconciliation practices may very well hold the key to unlocking long-term growth and trust among stakeholders, leaving a lasting impact on their financial landscape.