Understanding Financial Records in Bookkeeping 5025130632

Understanding financial records in bookkeeping is crucial for organizations aiming for effective financial management. Accurate record-keeping not only ensures compliance but also provides insights into fiscal health. Key documents, such as balance sheets and cash flow statements, are integral to this process. However, the real value lies in how these records are analyzed. Identifying trends and applying best practices can significantly enhance decision-making. What strategies can be employed to optimize this critical aspect of business operations?

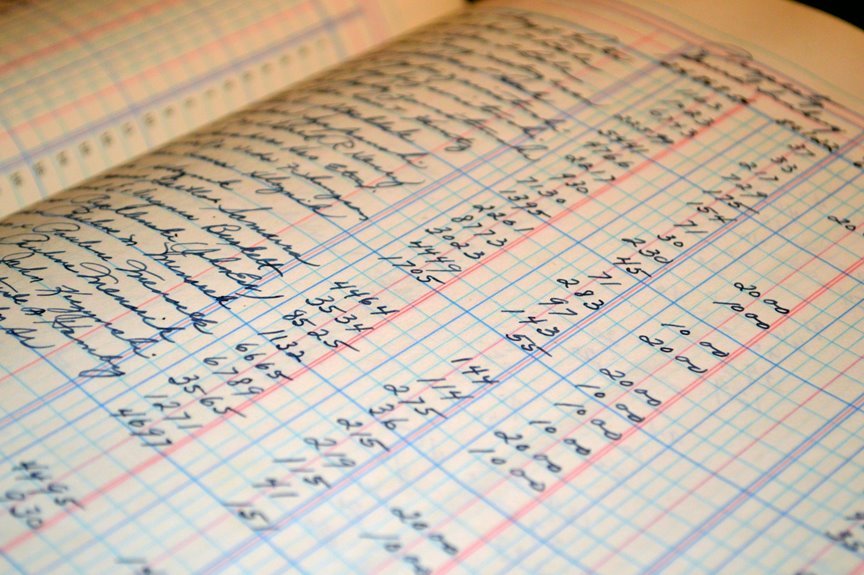

The Importance of Accurate Record-Keeping

Accurate record-keeping serves as the backbone of effective financial management, ensuring that businesses can track their income and expenses with precision.

Maintaining record accuracy fosters financial integrity, enabling organizations to make informed decisions. This practice not only supports compliance with regulations but also empowers businesses to identify trends and optimize performance, ultimately enhancing their ability to thrive in a competitive landscape.

Key Financial Documents in Bookkeeping

Financial documents form the foundation of effective bookkeeping, providing essential insights into an organization’s fiscal health.

Key components include financial statements such as balance sheets, income statements, and cash flow statements.

Utilizing bookkeeping software enhances accuracy and efficiency in managing these documents.

Together, these elements empower organizations to maintain transparency and make informed decisions, ultimately fostering financial freedom and sustainability.

Analyzing Financial Records for Better Decision-Making

While many organizations generate extensive financial records, the true value lies in their analysis for informed decision-making.

Effective data interpretation is essential for revealing trends and insights that guide decision analysis. By systematically evaluating financial data, organizations can enhance strategic planning, optimize resource allocation, and ultimately achieve greater autonomy in their operational choices, fostering an environment where informed decisions can thrive.

Best Practices for Maintaining Financial Records

Effective maintenance of financial records is critical for organizations aiming to uphold compliance and transparency.

Implementing digital tools enhances efficiency in record retention, allowing for streamlined access and organization. Regular audits of financial documents and adherence to industry standards ensure accuracy.

Additionally, establishing clear policies for data management fosters accountability, ultimately supporting the organization’s commitment to integrity and informed decision-making.

Conclusion

In the intricate tapestry of financial management, accurate record-keeping serves as the steadfast thread that binds an organization’s fiscal narrative. Each key document acts as a vibrant stitch, revealing patterns of prosperity and caution. By diligently analyzing these records, businesses illuminate their path forward, navigating through uncertainties with clarity. Embracing best practices in maintaining these records not only fosters transparency but also cultivates a resilient foundation, ensuring that the organization thrives amidst the ever-evolving economic landscape.